Your Alternative to a Japanese Credit Card

Prepaid & Easy

Apply online in minutes and enjoy cashless transactions in Japan with MobalPay Prepaid Mastercard

One-time setup fee: ¥2,970 and ¥385 monthly fee

Discover MobalPay:

The Perfect Solution for Your Needs

| Features and Benefit | MobalPay Prepaid Card |

Japanese Cash Card |

Japanese Credit Card |

|---|---|---|---|

| Cash Top-Up | |||

| Instant Approval | |||

| Deals and Discount | |||

| Online shopping and subscription | |||

| Offline Shopping | |||

| ATM Withdrawal | MobalPay is a prepaid card, and ATM withdrawals are not supported | ATM withdrawals are supported | Credit cards do not support ATM withdrawals |

| Easy Application | MobalPay offers an easy English application process and customer support | Requires Japanese paperwork and does not offer English customer support | Requires Japanese paperwork and has a high chance of rejection for short-term visa holders |

MobalPay, Your Payment Partner in Japan

Easy Setup

Apply online as quick as 10 minutes and get your card as fast as 2 days, delivered anywhere in Japan. No paperwork needed, just your Japanese Residence Card for approval.

Prepaid Mastercard®

Pay seamlessly with a Prepaid Mastercard issued by a Japanese bank for online and in-store shopping. No bank account needed.

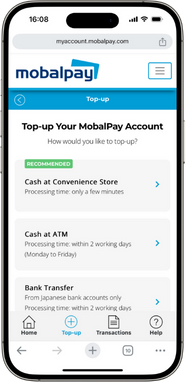

Expense Tracking and Easy Top-Up

Top-up instantly at convenience stores in Japan and track your expense near-realtime in your online account.

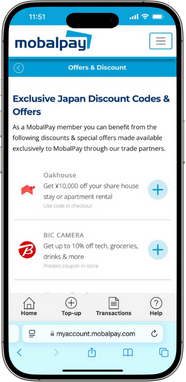

Special Deals and Discount

Enjoy special deals and discounts exclusive to MobalPay members. Save more while spending easily in Japan.

Reliable Customer Support

Get reliable and friendly support from English-speaking experts. No Japanese knowledge required.

Secure Payment Registered in Japan

MobalPay is licensed under Kanto Finance Bureau to issue Prepaid Payment Instruments via the Payment Services Act.

What Our Users Say - Watch Real Experiences

Hear directly from MobalPay users! Short videos with real voices from people living in Japan.

Get Started with MobalPay in 4 Steps

Apply for MobalPay

Fill out an English online application form and upload a photo of your valid Japanese Residence Card.

Pay the Setup Fee

After your application are approved, we'll email you a barcode to pay the ¥2,970 setup fee at any convenience store in Japan.

Receive Your MobalPay Card

We’ll ship your MobalPay card directly to your address on your Residence card.

Top-Up Money to Your Card

Log-in online to Activate & Top-up with cash at convenience stores nationwide and enjoy cashless transaction with MobalPay!

Apply For Your MobalPay Card

set-up fee

(tax included)

monthly fee

1st Month FREE!

Apply now and pay nothing until your ID is approved!

You'll get your MobalPay card within just a few days. There are no charges for the first month! After that, it's just ¥385 each each month.

One Card for Everything

Services, Subscriptions, and More

Mobile Suica

PayPay

Wise

Rakuten Pay

Mobile Pasmo

AUPay

Amazon

Booking.com

Uniqlo

SHEIN

Mercari

IKEA

Temu

Costco

7-Eleven

Family Mart

Aeon

Gyomu Super

Lawson

MyBasket

Kasumi

Daiso

Netflix

Google Play

YouTube

Disney+

iOS App Store

Amazon Prime

Spotify

Steam

KFC

Starbucks

Wolt

McDonald's

Burger King

Domino's

Convenience, Savings & Control

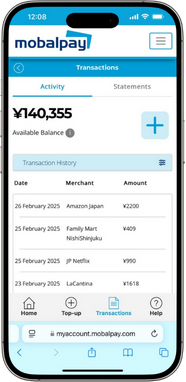

One Access in Your Online Account

Track, Manage, and

Stay Informed

View your latest transactions anytime, anywhere. Easily track spending, download statements.

Quick Top-Ups,

Unlimited Convenience

Top up with your preferred method and enjoy instant access to your funds. Simple, fast, and secure.

Exclusive Deals,

More Savings for You

Unlock special discounts and exclusive offers at top retailers in Japan.

How Your Monthly Fee Supports Charity

At MobalPay, we believe businesses should be a force for good. Just like our sister brand, Mobal, we are committed to creating a lasting impact on communities in need.

A portion of every monthly fee goes directly toward charity initiatives, providing essential support for food security, education, and economic empowerment. In 2023 alone, the Mobell Group donated over £3,000,000, transforming lives through meaningful projects.

For more than 30 years, Mobal has been dedicated to helping foreign residents in Japan while driving positive change globally. With MobalPay, your everyday spending fuels a mission of giving and empowerment.

Learn more about our impact

Customer Reviews: Real Stories from MobalPay Users

H.L. From USA  | Based in Hiroshima | 1 year in Japan

|

5

| Based in Hiroshima | 1 year in Japan

|

5

Q: How do you use MobalPay?

I use it at least once a week. It's been in constant use since I got it.

I can think of 4 regular experiences that were rather annoying due to my lack of a Japan-issued card:

- I regularly purchase from Yahoo Auctions. They don't accept foreign issued cards, and I was having to go to the convenience store to make payments.

- At some point over the last year, the website and mobile app for the shinkansen stopped accepting foreign issued credit cards. My partner lives in a neighboring town and we commute via train to see each other at least once a week.

- I occasionally shop at Costco. They only accept cash or Mastercard-issued cards. I didn't previously have a Mastercard.

- I've turned into a Starbucks person here, and topping up the rewards card is not possible with a foreign-issued card.

Mobalpay has helped me to truly live like a resident of Japan, with access to all of the platforms and conveniences someone with a Japan-issued credit card would have. Getting set up was seamless, as is topping up and making payments in stores or online. It's one of the most heavily used cards in my wallet!

Q: What features of MobalPay do you value most?It makes life here more convenient, keeps pesky little to-dos off my plate, and gives me access to everyday items a resident would need (another example - I purchased furniture when I moved here, and the online retailer Nitori also doesn't accept foreign issued credit cards. I didn't have my Mobalpay card at the time, and it was a huge hassle to do a bank transfer for ordering furniture and substantially delayed the shipment).

I also actually quite like and appreciate that my monthly fee is used toward investing in humanitarian causes.

Ece U. From Turkey  | Student (university)

| Based in Tokyo

| 5 months in Japan

|

5

| Student (university)

| Based in Tokyo

| 5 months in Japan

|

5

Q: How do you use MobalPay?

I use it for online shopping and grocery shopping a lot. Since my credit card from my own country can't be used for them. So I use it every week.

I think the customer service is great. They will help you very soon. Everything is clear and easy to understand which is usually hard for cards. Every move and purchase you make with your card comes to your phone in a moment. I think that's very important for safety.

M.P. From USA  | Based in Kobe | 5 years in Japan

|

5

| Based in Kobe | 5 years in Japan

|

5

Q: How often do you find yourself using MobalPay?

Fairly often for daily purchases/online purchases. Some stores in Japan only accept cash, so I use a combination of cash, PayPay, and MobalPay to pay for everything I need.

Q: How do you use MobalPay?

Daily expenses (groceries, shopping)/online purchases (Amazon, tickets)

Q: Does MobalPay help you manage your finances?

Yes it’s convenient. Easy to load and use.

It was so easy to setup, easy to reload money. I like that I get emails updating me on the current balance. GAICA sent me emails that said “Notice of your card usage” but not where the money was spent or how much was spent or what the current balance was. I had to login to the website to check. MobalPay is more convenient.

J.M. From Poland  | Project Manager, Tech

| Based in Tokyo

| 2 years in Japan

|

4

| Project Manager, Tech

| Based in Tokyo

| 2 years in Japan

|

4

Q: How do you use MobalPay?

I primarily use Mobalpay for online purchases.

Q: Does MobalPay help you manage your finances?

Since I want to use Mobalpay exclusively for online shopping, it helps me budget my spending on games/amazon/etc. I can charge up my MobalPay card at the start of the month, and not use any more than I have.

Being able to sign up and use a card in Japan where all the documentation and account settings are in English. Additionally, the process of topping up the card and seeing all your transactions is nice and easy!

Click to See More Reviews

- W.F.K Entrepreneur | Based in Tokyo | 5

-

Q: How often do you find yourself using MobalPay?

Q: How do you use MobalPay?

Daily, for both online purchases (as Amazon and coffee) and restaurants, travel, hotels, convenience stores

Amazon, travel, hotels, restaurants, daily life, convenience stores -

G.A. From Philippines

| Teacher in international school

| Based in Tokyo

| 1 year in Japan

|

4

| Teacher in international school

| Based in Tokyo

| 1 year in Japan

|

4

-

Q: How often do you find yourself using MobalPay?

Very regularly since I got the card.Q: How do you use MobalPay?

Q: Does MobalPay help you manage your finances?

Grocery, online shopping, convenience stores.

It does because unlike a credit card, I can manage my expenses to stick to the amount that I top-up. -

Sandi From South Africa

| English teacher

| Based in Fukui

| 1 year in Japan

|

5

| English teacher

| Based in Fukui

| 1 year in Japan

|

5

-

Q: Does Mobalpay help you achieve your financial goals?

Yes, Mobal has changed how I use my money. Now I don’t have to be paying with cash everywhere I go. It’s easier for me to plan ahead because I can pay for everything using one payment method (a card).Q: What do you primarily use your Mobalpay card for?

Q: Which features of Mobalpay do you find most valuable?

Grocery shopping and online orders.

I like the fact that I can easily top my card at a convenience store. -

R.A.M. From Canada

| Based in Maebashi, Gunma

| 5 years in Japan

|

4

| Based in Maebashi, Gunma

| 5 years in Japan

|

4

-

Q: How often do you find yourself using MobalPay?

Frequently. I use it for my monthly online orders/bills.Q: How do you use MobalPay?

Q: What features of MobalPay do you value most?

Mobal cell phone bill / Amazon / Online shopping

As a foreigner living in Japan I value being able to get a Mobalpay payment card quickly.

Being able to load money onto the payment card in a variety of ways that are easily accessible to me is a second appreciated feature.

Thirdly I enjoy being able to login to the Mobalpay website and being able to track and see my payment card input/output. -

S.B. From UK

| Teaching in University

| Based in Tokyo

| 9 years in Japan

|

4

| Teaching in University

| Based in Tokyo

| 9 years in Japan

|

4

-

Q: How often do you find yourself using MobalPay?

1 to 2 times a month.Q: How do you use MobalPay?

Q: What features of MobalPay do you value most?

Online purchases- in particular flights.

Online access with clear and easy to use interface and English support. - J.C. Caregiver | Based in Yamanashi | 4.5

-

Q: How often do you find yourself using MobalPay?

When I purchase my foods and stuff.Q: How do you use MobalPay?

For my food allowances and travel booking.Q: Does MobalPay help you manage your finances?

Q: What features of MobalPay do you value most?

Yes, because I just spend how much I load into my card so I can manage not to overspend.

Easy to apply and fast response and also we can see the history of usage.

I don't mind there are monthly fee because I like the fact that the money is used for charity work. - M.G.I JET | Based in Hiroshima | 16 years in Japan | 4

-

Q: How often do you find yourself using MobalPay?

For daily shopping, but not too often.Q: How do you use MobalPay?

Q: What features of MobalPay do you value most?

Groceries, food, convenience stores. No online shopping. I would like that one day I will be able to use MobalPay for anything and everywhere.

The most valuable MobalPay tool is the English customer service and ease of use.

Give with Purpose

Use MobalPay

Frequently Asked Questions

Your MobalPay card is different. It’s a Japanese-issued Mastercard with few limitations. You can use it almost anywhere in Japan. However, since it’s a prepaid card, you can’t deposit your salary or withdraw cash from an ATM. Otherwise, you can use it like your Mastercard from home.

*Subject to ID and fraud checks.

You can still use your remaining balance even if there's an unpaid monthly fee.

If you haven't paid the monthly fee, we won't charge you another one. We'll pause the billing until the fee is next paid. So, you could have a low or zero balance for months without any additional cost.